Do you wonder why some people are wealthier than others? How is it that some individuals create significant financial wealth in a limited span of time? What are they doing that others are not? Can their approach be learnt and replicated? What is that approach?

Several applications of economics provide some answers. Actually, some other disciplines in the social sciences, such as sociology, public policy, anthropology, also provide answers but we shall focus on economics and finance. Nobel prize-winning economist Robert Solow’s, economic growth model neatly explains the reasons for the wealth gap among nations and people. [Fun fact – four PhD students taught by Solow went on to become top economists and each won the Nobel prize]. These growth models highlight that accumulation of financial wealth is an outcome of timely planning.

Working individuals are expected to have easy liquidity (money that is readily available for immediate spending) along with a growth trajectory of their earnings based on their productivity levels. In simpler words, working professionals always experience a ‘feel rich’ factor. But, if one wants to create wealth and a financial legacy for the family then one must invest the financial resources carefully. Elementary economics tells us that resources, particularly financial, are almost always scarce so we ought to utilise them carefully. To do this, we must know how to utilise them, where to direct them, and when to pull the plug on these investments.

There is an art & science to financial wealth creation. Wealth can be created by systematically planning the allocation of the existing resources into sound financial instruments. Yes, you guessed it right – this is essential ‘investment’. As a thumb rule, if you carefully invest in financial instruments that are not excessively risky for a long duration of time then there are higher chances of you reaping good returns. In this rule, there are four key factors. Not all of them are under our control. These factors are ‘financial instruments’, ‘risk’, ‘time duration’, ‘return on investment’. Optimising these four critical factors will determine how much and for how long you will professionally work to create wealth for yourself and for your family. Only when you get the right balance between these four factors, your money will make more money even while you sleep. Actually, Warren Buffet said something on these lines once. He claimed, “if you don’t find a way to make money while you sleep then you will work until you die”. The statement is a bit dramatic but you get the point!

Creating multiple income streams or making money work for you is important to ensure you continue to live a life of comfort and secure life when one is not actively working.

Let us share two basic ideas to help you achieve your financial goals and create wealth:

First, identify your financial goals. While making the financial goals keep them realistic to allow you to create wealth in long term. Choose an appropriate timeline for your financial goals. Second, given your financial goals, always remember the power of compounding. Compounded investments are key to financial wealth. The idea of compounding focuses on reinvesting the financial returns back into the initial investment to earn higher growth. Thus, the earlier you start investing, the better will be the rewards. Always remember that no investment is too small. Thus, regardless of your money income, one must start the journey of financial wealth creation early on in life and consistently go on investing to create financial wealth.

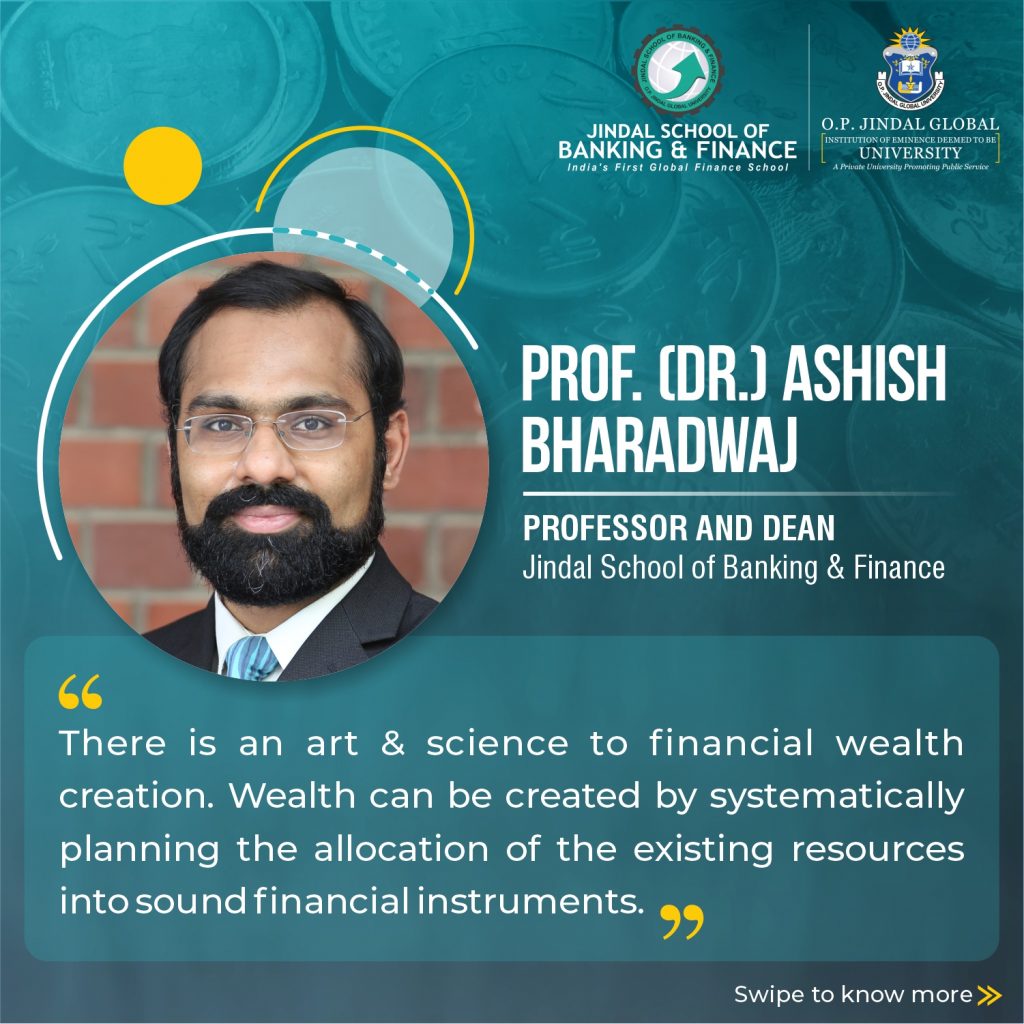

Jindal School of Banking & Finance, O.P. Jindal Global University’s (JGU) Finance School, is organising a workshop on Financial Wealth Creation, for graduation high-school students, so that the young minds learn the art & science of financial wealth creation early on in their life; thus, getting advantage of the time input for financial wealth creation. To learn more about the art & science of financial wealth creation, register for the fascinating workshop on financial wealth creation organised by the O.P. Jindal Global University (JGU).

Click here to register for the Workshop on Financial Wealth Creation.

Written By: Prof. (Dr.) Ashish Bharadwaj, Professor and Dean, Jindal School of Banking & Finance and Prof. (Dr.) Chavi Asrani, Assistant Professor, Jindal School of Banking & Finance.