A career in finance is becoming more exciting than ever before! It combines a few of the most rapidly evolving industries, including banking, financial services, and digital technologies. Indian capital markets have been growing continuously over the past few decades, creating significant career opportunities for your graduates. To cater to this growing need of professionals in the Indian capital markets and financial services sector, B.Com. (Hons.) in Capital Market is jointly offered with NSE Academy. The programme enables students to develop skills through in-campus industry-related projects by NSE academy, market simulation software NSMART, visits to financial centres, industry seminars and workshops.

The programme enables students to develop skills to secure various career opportunities emerging in the field of finance, including financial services and capital markets.

What Makes It Different at JGU?

The B.Com. (Hons.) Capital Markets programme at JSBF is designed to provide students with a comprehensive understanding of the financial world. The program is officially affiliated with CFA under its University Affiliation Program of CFA Institute, New York. In the first year, students will be introduced to foundational concepts in microeconomics, macroeconomics, financial mathematics, business statistics, and financial reporting & analysis, among others. Additionally, they will develop proficiency in business communication and critical thinking, and gain practical knowledge of capital market operations through mandatory industry or research internships.

In the second year, students will delve deeper into advanced topics such as financial modelling, financial analytics (Python/R), and blockchain and cryptocurrency, and explore areas like equity research and commodities market through industry-specific electives. They will also gain hands-on experience with simulated market trading application, NSMART, and practical research projects with JSBF and NSE faculty.

The third year is designed to give students specialized knowledge in areas like mutual funds, equity research, and foreign exchange and currency derivatives. Students will have the opportunity to learn from senior industry experts who co-teach with JSBF faculty in the classroom and offer practice-oriented, cross-listed & industry-relevant elective courses. The programme also features CAPITAL, a comprehensive application by practitioners for impactful teaching & learning, which provides semester-long electives and lecture series that allow students to work on contemporary problems in finance, banking, financial services, insurance, and entrepreneurship in allied fields. While, the final year offers the pool of electives offered by 12 schools in the University.

Duration- 4 Years

Certification & Training

Successful completion of Class XII or equivalent examination in any stream from an Indian or International Board (CBSE | ISC | State Board | NIOS | CAIE* | IB**) recognized by AIU – Association of Indian Universities.

* CAIE (Cambridge Assessment International Education)

** IB (International Baccalaureate) Diploma / Course (Certificate) students pursuing a minimum of 3 HL (Higher Learning) & 3 SL (Standard Learning) subjects must secure a minimum of 24 Credits.

Applicants are selected through a holistic admission process conducted over three rounds based on X and XII grades, Supplementary Questions, Entrance Exam (SAT ≥ 1100 score | ACT ≥ 27 Points | UGAT/ CUET ≥ 60 Percentile or Online JSAT (Jindal Scholastic Aptitude Test) ≥50Percentage, conducted by JGU.

Jindal School of Banking & Finance follows a holistic admission process. An applicant is evaluated on the basis of a combination of Academic and non-academic performance scores.

The online admission process for JSBF undergraduate programmes for the academic year is open. Please find the details of the selection process below.

Round 1- Application Assessment

X and XII Board Exam Scores

Passport Size Photograph

Qualifying Competitive Examination Score

Supported Documents for Extra-Curricular Activities

An Online Application Number will be displayed upon successful submission of the form. The applicant must use the ‘Application Number’ as a reference while communicating with us.

Round 2- Online Entrance Examination

Appearing for Entrance Exam (JSAT, SAT, UGAT, CUET)

Round 3- Online Faculty Interview

Waitlisted Applicants

Important Advisory for Students and Parents

O.P. Jindal Global University (JGU) does not appoint or authorise any agent, intermediary, or consultant for admissions to any the undergraduate, postgraduate and doctoral programmes offered by JGU.

If any individual or organisation approaches you demanding money, donations, or favours for admission, please immediately report the matter to the police and to the Registrar of the O.P.Jindal Global University at registraroffice@jgu.edu.in

All admissions to JGU’s academic programmes are conducted strictly on merit. JGU has no management quota, no donation/capitation seats, no NRI/Foreign National quota, and no special quota of any kind.

Paying or offering any form of donation or capitation fee for admission to JGU is illegal, and individuals involved in such activities are liable for criminal prosecution.

For all official information and admission-related queries, please contact the Admissions Office directly and apply only through the University’s official website: www.jgu.edu.in

Tuition Fees*: 5,00,000 (INR per annum)

| Particulars | Amount in (Rs.) |

| Accommodation Charges* | 2,31,100 per annum |

| Other Allied Services Charges* (Other Allied Services including but not limited to food, Laundry, Security Services, Housekeeping charges, electricity etc.)* | 1,24,900 per annum |

| Refundable Security Deposit** (One time payment) | 50,000 |

*The Tuition fee, accommodation charges and other allied service charges are subject to an annual increase of up-to 10%.

**The security deposit will be fully refunded, subject to the completion of studies and/or receipt of a ‘No Dues Certificate’. The security deposit shall not carry any interest.

JSBF offers several pathways for students of B.Com. (Hons.) Capital Markets to choose from, based on their interests and career goals. Some of these pathways include Trading and Risk Management, Insurance and Risk Management, Wealth Management and Financial Planning, Marketing of Financial Products and Services, Financial Consultancy and Entrepreneurship, and more.

For those interested in pursuing professional certifications such as CFA, CFP, and FRM, JSBF provides ample opportunities for preparation and training. Additionally, the programme curriculum is designed to prepare students for postgraduate studies in finance-related fields such as MBA and M.Sc. in Finance.

Students who aspire to pursue a career in academia or research can explore research opportunities and academic pathways available through JSBF’s partnerships with industry and academic institutions.

Those interested in entrepreneurship and start-ups can benefit from the school’s focus on interdisciplinary education and experiential learning, as well as from the entrepreneurial training provided through workshops and courses.

JSBF also offers pathways for those interested in investment banking, financial consulting, private banking, wealth management, private equity, and venture capital, with a focus on practical skills, industry certifications, and internships to help students gain hands-on experience in these fields.

Trading & Risk Management

Financial Services

Consulting & Entrepreneurship

Embracing a Global Outlook at JSBF

The Jindal School of Banking & Finance (JSBF) stands at the forefront of international academic collaboration with over 80+ partnerships with distinguished international universities. With a focus on cross-cultural learning, JSBF provides its students with unique opportunities such as Semester Exchange, Study Abroad, Dual Degree and Master’s Progression programs. These initiatives ensure an enriching academic and cultural experience, preparing students to thrive in an interconnected world. By embracing a global outlook, JSBF equips its students to become future-ready leaders in banking, finance, and beyond.

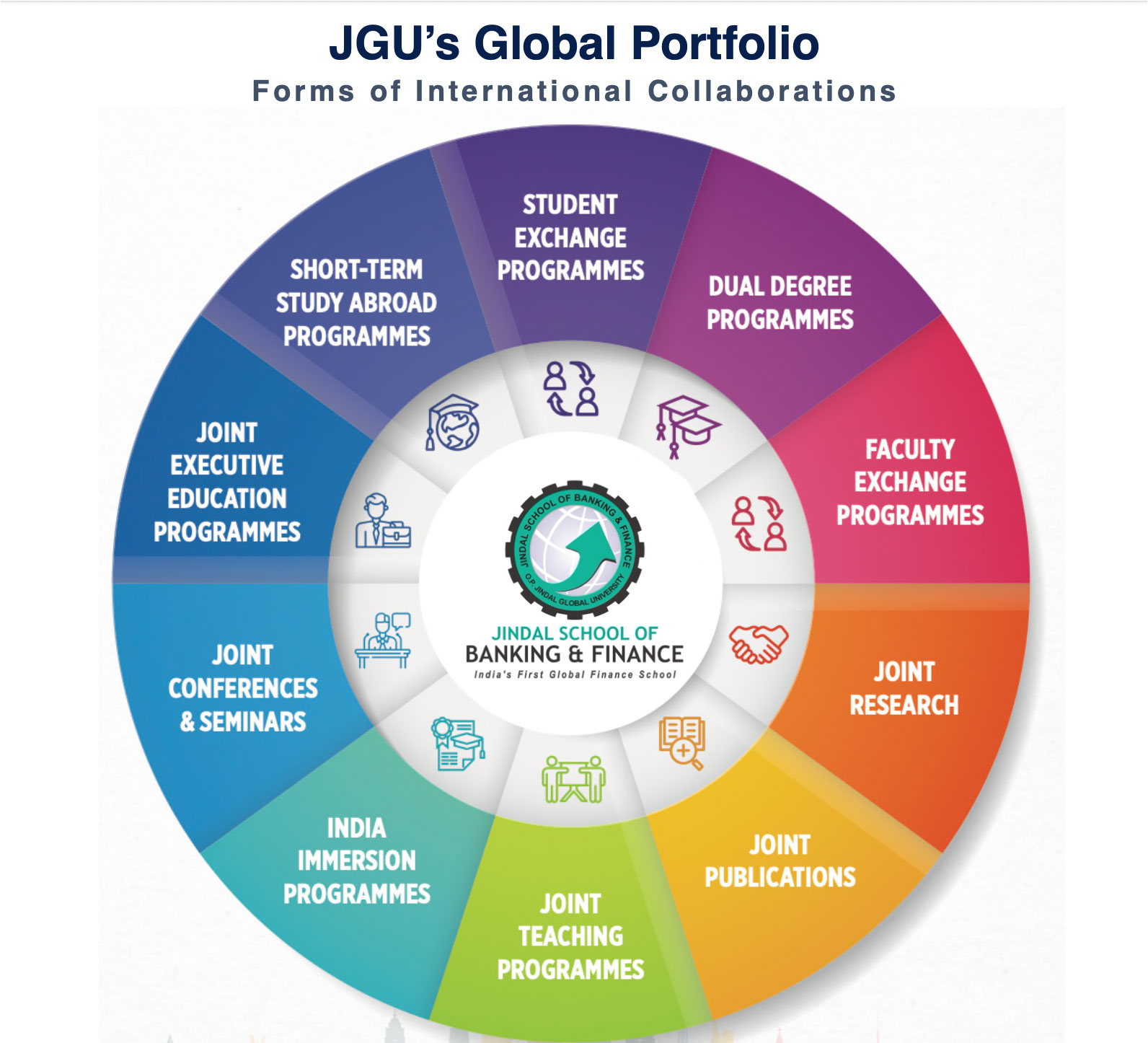

Global Portfolio

The Jindal School of Banking & Finance (JSBF) is a beacon of global engagement, offering diverse avenues for international academic and professional collaborations.

Through these initiatives, JSBF ensures a holistic educational journey, equipping students and faculty with the skills and perspectives necessary for success in an increasingly interconnected world.

Where Can JSBF Take You?

At the Jindal School of Banking & Finance (JSBF), the world is your campus. Our extensive global partnerships open doors to leading institutions across continents, ensuring unparalleled academic and cultural exposure.

JSBF’s global reach ensures that you gain an education that transcends borders, preparing you to succeed in an interconnected world.

Bridging Continents: International Student Engagement at JSBF

Through partnerships with leading institutions like the University of Nottingham, the University of Sydney, UC Berkeley, Frankfurt School of Finance, and many more, we offer diverse programs tailored to enhance student experiences. These include:

Our collaborations with industry leaders like Bloomberg and premier initiatives such as the New Colombo Plan ensure students are well-equipped for a world of possibilities. At JSBF, we are committed to bridging continents and connecting talent with opportunity.

| Name | Designation | Contact Number | Email ID |

|---|---|---|---|

| Mr. Vikram Singh Tomar | Sr. Director | +91-8396907440 | vstomar@jgu.edu.in |

| Ms. Chinky Mittal | Sr. Manager | +91-7027850361 | cmittal@jgu.edu.in |

| Mr. Taranjeet Singh | Manager | +91-7419748923 | tsmanku@jgu.edu.in |

| Ms. Akanksha Sajwan | Assistant Manager | +91-7419614758 | akanksha.sajwan@jgu.edu.in |