B.Com. (Hons.) Finance & Entrepreneurship is India’s first flagship programme, which provides experiential learning to students interested in developing their skills in the field of finance and entrepreneurship. The students will learn the nuances of various entrepreneurship activities and the role played by finance as a discipline to make new ventures successful.

The programme enables students to develop different skills that are highly sought-after in the industry and help build a good career in the fields of finance and entrepreneurship. The programme extensively focuses on the different tools and techniques required to launch and build new ventures and the different financial skills required to make the new and existing ventures successful. This will help the students develop skills to manage small and family businesses

What Makes It Different at JGU?

The curriculum aims to prepare students for the financial services industry or entrepreneurial journeys by graduation. Students have opportunities for learning from start-up internships, workshops focused on entrepreneurship, and hands-on training programmes using capstone projects (computer simulation) and LEGO® Serious Play® methods. In addition, students receive skill-based training on Microsoft Excel, R, and Tableau. The curriculum also includes relevant cases, simulations, and online courses offered by Harvard Business Publishing.

To obtain a 4-year B.Com. (Hons.) Finance & Entrepreneurship degree, a student needs to complete 180 credits; it covers 164 credits for the core as well as elective courses, and the remaining 16 credits should be earned from other activities that include 08 credits from industry internships and the remaining 08 credits from research, TA ship, and other co-curricular activities.

The programme curriculum is divided into three categories: Fundamentals, Explore, and Specialise. The Fundamentals category consists of foundational courses that introduce students to various managerial functions, essential knowledge, and skills. The Explore category builds on the foundation laid by the fundamental courses and allows students to explore different courses at a slightly more advanced level. The Specialise category offers elective courses that enable students to choose subjects of their interest to pursue a career after graduation.

In the first year, students study Principles of Management, Accounting Essentials for New Ventures, Consumer Theory & Psychology, Entrepreneurial Economics, and Emerging Technologies: Impact on Future of Business in the first semester. In the second semester, students study Foundations of Entrepreneurship and Start-up Ecosystem, Financial Statements for Entrepreneurs, Managing Operations of a Start-up, Company Law and other Legal Aspects of Entrepreneurship, and Sustainability & Environment Studies.

In the second year, students study Entrepreneurial Marketing, Finance for Entrepreneurs, Entrepreneurial Analytics, and Design Thinking & Innovation for Entrepreneurs in the third semester. In the fourth semester, students study Workforce Management for Entrepreneurs, Organisation values, CSR and Ethics, Venture Capital & Private Equity, and Foundations of Intellectual Property.

In the third year, students have an option to study a semester abroad (optional) in the fifth semester. In the sixth semester, students study CAPSTONE (Computer Simulation), Blue Ocean Strategy for Entrepreneurs, Private Wealth Management, Insurance and Investment, Security Analysis & Portfolio Management, and Behavioural Economics and Finance.

Duration- 4 Years

Successful completion of Class XII or equivalent examination in any stream from an Indian or International Board (CBSE | ISC | State Board | NIOS | CAIE* | IB**) recognized by AIU – Association of Indian Universities.

* CAIE (Cambridge Assessment International Education)

** IB (International Baccalaureate) Diploma / Course (Certificate) students pursuing a minimum of 3 HL (Higher Learning) & 3 SL (Standard Learning) subjects must secure a minimum of 24 Credits.

Applicants are selected through a holistic admission process conducted over three rounds based on X and XII grades, Supplementary Questions, Entrance Exam (SAT ≥ 1100 score | ACT ≥ 27 Points | UGAT/ CUET ≥ 60 Percentile or Online JSAT (Jindal Scholastic Aptitude Test) ≥50Percentage, conducted by JGU.

Jindal School of Banking & Finance follows a holistic admission process. An applicant is evaluated on the basis of a combination of Academic and non-academic performance scores.

The online admission process for JSBF undergraduate programmes for the academic year is open. Please find the details of the selection process below.

Round 1- Application Assessment

X and XII Board Exam Scores

Passport Size Photograph

Qualifying Competitive Examination Score

Supported Documents for Extra-Curricular Activities

An Online Application Number will be displayed upon successful submission of the form. The applicant must use the ‘Application Number’ as a reference while communicating with us.

Round 2- Online Entrance Examination

Appearing for Entrance Exam (JSAT, SAT, UGAT, CUET)

Round 3- Online Faculty Interview

Waitlisted Applicants

Important Advisory for Students and Parents

O.P. Jindal Global University (JGU) does not appoint or authorise any agent, intermediary, or consultant for admissions to any the undergraduate, postgraduate and doctoral programmes offered by JGU.

If any individual or organisation approaches you demanding money, donations, or favours for admission, please immediately report the matter to the police and to the Registrar of the O.P.Jindal Global University at registraroffice@jgu.edu.in

All admissions to JGU’s academic programmes are conducted strictly on merit. JGU has no management quota, no donation/capitation seats, no NRI/Foreign National quota, and no special quota of any kind.

Paying or offering any form of donation or capitation fee for admission to JGU is illegal, and individuals involved in such activities are liable for criminal prosecution.

For all official information and admission-related queries, please contact the Admissions Office directly and apply only through the University’s official website: www.jgu.edu.in

Tuition Fees*: 5,00,000 (INR per annum)

| Particulars | Amount in (Rs.) |

| Accommodation Charges* | 2,31,100 per annum |

| Other Allied Services Charges* (Other Allied Services including but not limited to food, Laundry, Security Services, Housekeeping charges, electricity etc.)* | 1,24,900 per annum |

| Refundable Security Deposit** (One time payment) | 50,000 |

*The Tuition fee, accommodation charges and other allied service charges are subject to an annual increase of up-to 10%.

**The security deposit will be fully refunded, subject to the completion of studies and/or receipt of a ‘No Dues Certificate’. The security deposit shall not carry any interest.

Graduates of the B.Com. (Hons.) Finance & Entrepreneurship programme have a range of career opportunities to choose from, including:

The Office of Career Services at Jindal School of Banking & Finance provides students with support and guidance to help them find excellent placement opportunities in these and other sectors. Our students have completed valuable internships and gained practical experience in various areas, making them well-equipped to face the challenges of the world successfully.

The B.Com. (Hons.) Finance & Entrepreneurship programme curriculum is designed to provide students with a strong understanding of banking, finance, and the skills needed to start their own ventures. In addition to foundational and functional courses, students have the opportunity to choose from a variety of electives to build advanced skills in their areas of interest. Some of the elective courses available to students include:

In addition to these courses, students also participate in intensive workshops to develop essential entrepreneurial skills and undertake at least one internship, preferably with start-ups, during their semester breaks. The programme also includes a Capstone course, a computer simulation in which students apply the skills and knowledge gained throughout the programme to real-world situations. Students interested in starting their own ventures are supported through the Start-up Founder Series and JGU’s cash support for promising ideas.

Embracing a Global Outlook at JSBF

The Jindal School of Banking & Finance (JSBF) stands at the forefront of international academic collaboration with over 80+ partnerships with distinguished international universities. With a focus on cross-cultural learning, JSBF provides its students with unique opportunities such as Semester Exchange, Study Abroad, Dual Degree and Master’s Progression programs. These initiatives ensure an enriching academic and cultural experience, preparing students to thrive in an interconnected world. By embracing a global outlook, JSBF equips its students to become future-ready leaders in banking, finance, and beyond.

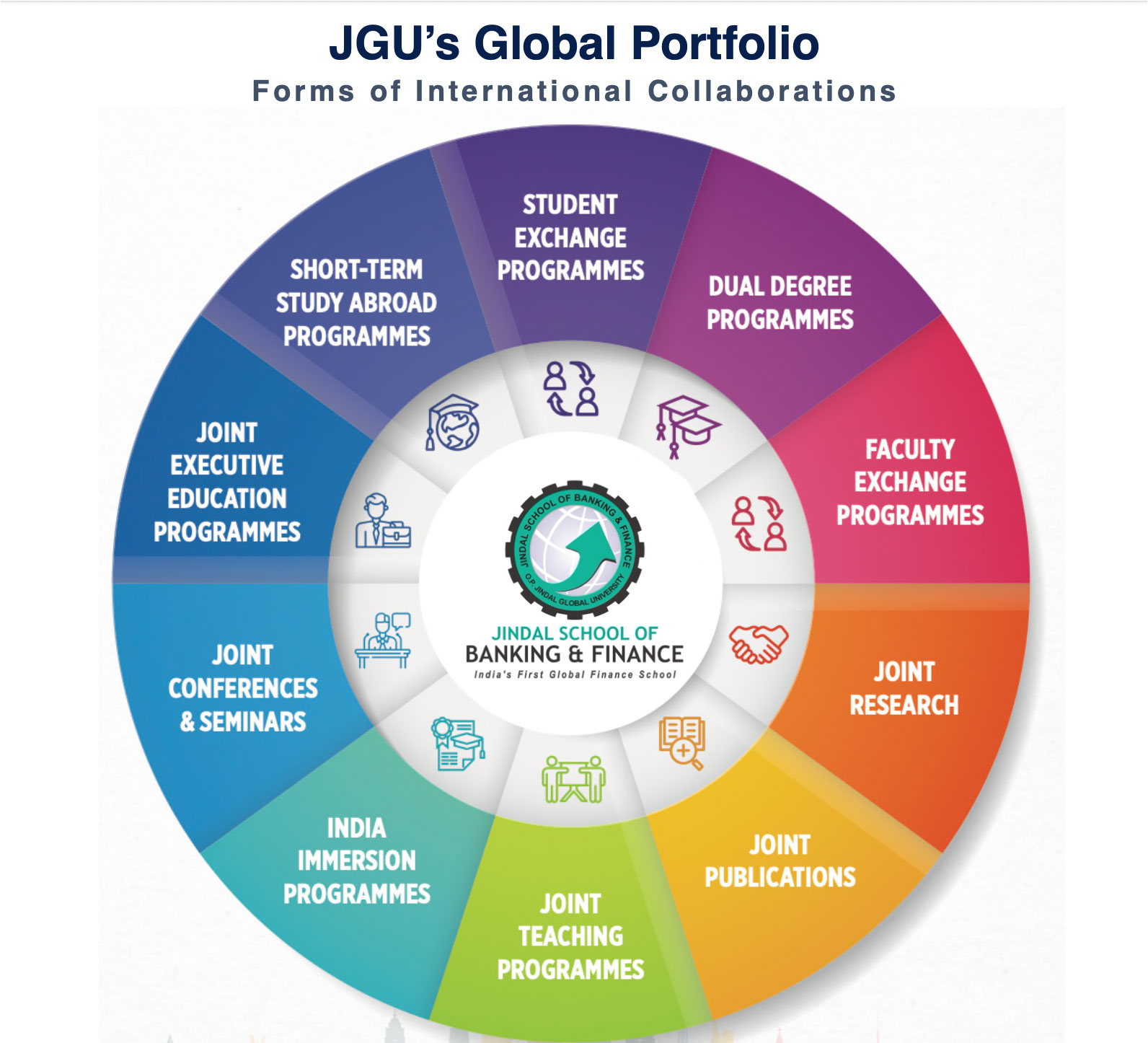

Global Portfolio

The Jindal School of Banking & Finance (JSBF) is a beacon of global engagement, offering diverse avenues for international academic and professional collaborations.

Through these initiatives, JSBF ensures a holistic educational journey, equipping students and faculty with the skills and perspectives necessary for success in an increasingly interconnected world.

Where Can JSBF Take You?

At the Jindal School of Banking & Finance (JSBF), the world is your campus. Our extensive global partnerships open doors to leading institutions across continents, ensuring unparalleled academic and cultural exposure.

JSBF’s global reach ensures that you gain an education that transcends borders, preparing you to succeed in an interconnected world.

Bridging Continents: International Student Engagement at JSBF

Through partnerships with leading institutions like the University of Nottingham, the University of Sydney, UC Berkeley, Frankfurt School of Finance, and many more, we offer diverse programs tailored to enhance student experiences. These include:

Our collaborations with industry leaders like Bloomberg and premier initiatives such as the New Colombo Plan ensure students are well-equipped for a world of possibilities. At JSBF, we are committed to bridging continents and connecting talent with opportunity.

| Name | Designation | Contact Number | Email ID |

|---|---|---|---|

| Mr. Vikram Singh Tomar | Sr. Director | +91-8396907440 | vstomar@jgu.edu.in |

| Ms. Chinky Mittal | Sr. Manager | +91-7027850361 | cmittal@jgu.edu.in |

| Mr. Taranjeet Singh | Manager | +91-7419748923 | tsmanku@jgu.edu.in |

| Ms. Akanksha Sajwan | Assistant Manager | +91-7419614758 | akanksha.sajwan@jgu.edu.in |