The Central Excise (Amendment) Bill, 2025

January 16, 2026 2026-01-16 12:05The Central Excise (Amendment) Bill, 2025

The Central Excise (Amendment) Bill, 2025

By Adiiti Aggarwal

Figure 1: Tobacco Photo by Haim Charbit (@haim_charbit18) / Source: Unsplash

Executive Summary

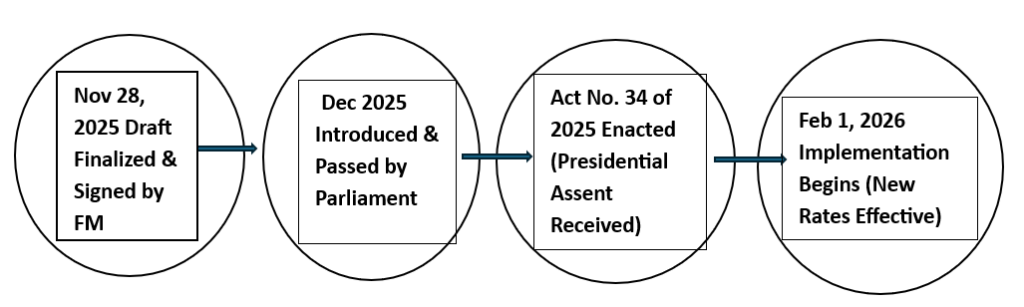

The Central Excise (Amendment) Bill, 2025 (Bill No.143 of 2025) reflects a shift in fiscal strategy by the Government of India to anticipate the end of the Goods and Services Tax (GST) Compensation Cess. As passed, this legislation (Act No.34 of 2025) makes substantial changes to the Fourth Schedule of the Central Excise Act, 1944 with regard to excise duty rates for tobacco and tobacco products; these increases will result in higher excise duty for these two products than they currently have under GST.

The primary goal of this bill is to maintain revenue neutrality: as GST Compensation Cess phases out, the Government of India intends to offset this total amount of tax by introducing the same amount through Basic Excise Duty. By maintaining the same level of tax for these products after the cessation of the GST Compensation Cess, the Government of India is able to maintain retail prices for these harmful products and thereby protect public health objectives. This also provides a permanent source of revenue for the Consolidated Fund of India. Unlike GST Compensation Cess, which was required to be passed through to state governments, the revenue generated from this increase in excise duties will now be incorporated into the central pool of taxes. This change in combination with the additional revenue generated through the taxation process will create changes to the fiscal relationship between the Centre and the States.

Background and Legislative Context

Prior to July 1, 2017, the tobacco industry had been the primary source of exclusive revenue for the Union Government through taxation under the Central Excise Act, 1944. The introduction of GST in 2017 encompassed many of the existing central excise duties to include them under GST with an exception of Entry 84 of List I (Union List), Seventh Schedule of the Constitution, which allowed the Centre to continue to levy excise duty on tobacco and petroleum products over and above, and separate from GST. To incentivise the states to participate in the GST, the Centre charged states a “Compensation Cess” on those goods considered to be demerit goods (tobacco, alcohol), in order to fund the revenue shortfalls of the states generated by the feedback from revenue generated from payments made by the Centre to compensate for revenue losses incurred by states as a result of GST being implemented instead of excise tax.

For the purpose of keeping total taxation low, the Basic Excise Duty on tobacco was substantially reduced in 2017 in order to accommodate the introduction of the Compensation Cess. The Compensation Cess will cease on or about the time the repayment of the debt incurred by states as a result of this will be fully repaid. Without implementation of offsetting measures, such as from the Cess being removed, there would be a sudden decrease in the price of tobacco and cigarettes. This Bill has created an opportunity to bring the Excise Duty back to higher levels using the “fiscal space” created when the Cess was removed and thus, preserve the Total Tax Incidence (TTI) for Excise.

Objectives

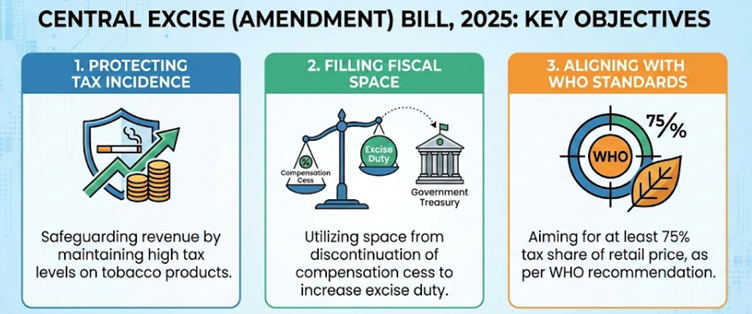

Figure 2: Strategic Objectives of the Bill Source: AI-generated visualization

Key Provisions

The legislation mandates a substantial increase in Central Excise duties across key tobacco categories, revising the existing tariff structure to secure revenue stability and discourage consumption. The new regime imposes steeper rates as follows:

Unmanufactured Tobacco: The rates increased to 70% for many varieties (i.e., Flue-cured Virginia, Sun-cured, Burley), up from the prior rate of 64%.

Cigarettes (Filter) – Length not exceeding 65mm – this category will be increased to Rs. 3000 per thousand cigarettes from Rs. 440 per thousand; Length greater than 75mm – the new rate will be Rs. 11000 per thousand from Rs 735.

Chewing Tobacco will substantially increase from 25% to 100%. Tobacco refuse will be increased to 60% from 50%. Other manufactured tobacco, i.e., Hookah or Gudaku Tobacco, will see increases to 40% from 25%.

Policy Implications

Revenue Protection: As the GST Compensation Cess rate has now been eliminated, this amendment will ensure the state does not suffer any loss of revenues upon this action, as the Treasury will not be receiving any new revenue during this time.

Price Stability (Tax Burden): With the transfer of the tax burden from a cess to an excise tax, the government will be able to keep the total tax on consumers constant, thereby eliminating the possibility of a rapid decrease in the price of tobacco products once the cess is eliminated without raising the excise.

Government Financial Impact on a Neutral Basis: According to the Financial Memorandum, there is no recurring or one-time cost impact on the Government of India as a result of the Bill.

Shift in the revenue distribution: The Central Excise taxes will now be included in the Divisible Pool of Taxes, whereas before the GST Compensation Cess was designated only for compensating states. This means that 41% of these Central Excise revenue will now fall on state governments based on the Finance Commission formula, thus fundamentally changing how these funds will be used by state governments.

Policy Recommendations

The central government must notify the new rates at a time exactly matching the cessation of the GST Compensation Cess to ensure that there is no double taxation or periods of under-taxation.

The government must monitor consumption patterns for these products due to the significant increase in the excise duty on some items like chewing tobacco (from 25% to 100%). There may be movement from the regulated market to the unregulated market as a result of these increases.

The Government must take advantage of the additional fiscal space created by this Bill to continuously assess the tobacco duties with regard to its public health and revenue-related objectives.

Health Security Cess and Harmonization: The government must ensure smooth alignment between The Act and the concurrently-enacted ‘Health Security and National Security Cess Act, 2025’ (which targets only Pan Masala and Gutkha based on their production capacity), to eliminate the possibility of current arbitrage between products containing tobacco versus those containing other forms of nicotine (in this case, tobacco accommodation).

Conclusion

The Central Excise (Amendment) Bill, 2025 provides a roadmap to transition tobacco tax levels away from the temporary GST Compensation mechanism to a more permanent excise tax system. By proactively raising the upper limit of excise duty rates, the government protects its revenue interests and maintains high barriers against tobacco products, ensuring that once the compensation cess sunsets, there won’t be any unintended unintended fiscal or social impact.

References

Cabinet approves The Central Excise (Amendment) Bill, 2025 – Press Information Bureau (PIB) Link:https://www.pib.gov.in/PressReleasePage.aspx?PRID=2212168®=3&lang=2

The Central Excise (Amendment) Bill, 2025 (As Introduced) – Digital Sansad (Lok Sabha Repository) Link:https://sansad.in/getFile/BillsTexts/LSBillTexts/Asintroduced/As%20intro%20(1)1212025123516PM.pdf?source=legislation

The Gazette of India (Official Website) – Department of Publication, Ministry of Housing and Urban Affairs Link:https://egazette.gov.in/(S(tkcl030erhlwcvybi1svkfxr))/default.aspx

The Central Excise (Amendment) Bill, 2025 (Bill Track) – PRS Legislative Research Link: https://prsindia.org/billtrack/the-central-excise-amendment-bill-2025

List of Bills – Ministry of Parliamentary Affairs Link:https://mpa.gov.in/bills-list

Track Information on Bills (General) – PRS Legislative Research Link:https://prsindia.org/billtrack

Synopsis of Debates – Lok Sabha, Digital Sansad Link: https://sansad.in/ls/debates/synopsis

All Press Releases (Ministry of Finance) – Press Information Bureau (PIB) Link: https://www.pib.gov.in/allRel.aspx?reg=3&lang=2

Legislation / Bills Search – Digital Sansad Link:https://sansad.in/ls/legislation/bills

About the author

Adiiti Aggarwal is a Master’s student in Economics at Shiv Nadar University, currently interning at the Jindal Policy Research Lab. She holds a Bachelor’s degree in Business Economics from the University of Delhi. Her research interests include development Economics, public policy, sustainable development, and governance.