At Jindal School of Banking & Finance (JSBF), we understand the importance of highly trained professionals in the fields of technology, innovation, analytics, finance, accounting, and banking. Our undergraduate degree programmes are designed to equip you with the skills and knowledge needed to become a future business leader in this rapidly evolving industry.

Students

University Faculty & Staff

Collaborations with International Universities

Alumni Network

Publications

The banking systems and other relevant financial institutions have become cornerstones of modern society, and with the inclusion of financial technology, the need for finance and banking experts has increased significantly. The basic study and research of banking and financial systems and institutions is usually obtained through a B.Com Hons course; however, other related disciplines can be pursued to broaden one's mindset.

For an educational institution like the Jindal School of Banking & Finance, the goal has been to build highly trained professionals for the various fields related to banking and finance, such as accounting, analysis, innovation, and technology. We are always keeping up with the global standards in all our banking and finance-related programmes by incorporating the latest technological advancements in the field of finance and banking.

JSBF adds global relevance to their courses by introducing students to ethical, environmental, and developmental issues. These humble roots and noble practices allow students to join workforces with the vision of being a global citizen and organise their career and contributions accordingly. The Jindal School of Banking & Finance is among the best B.Com colleges in Delhi, having ties to international organisations, and facilitating semester exchanges, study abroad programmes and much more.

At the Jindal School of Banking & Finance, we take great measures to establish real-world connections with knowledge and insights acquired in the classrooms through practical examples and endeavours. JSBF Global B.Com courses are currently known for 80+ active international partnerships with global institutions that meet the academic rigour and cultural values in crafting a global perspective and networks.

To be precise, JSBF has partners and organised semester exchange and study abroad programmes with the following countries: Australia, Italy, France, Germany, Israel, USA, United Kingdom, Vietnam, Taiwan, Philippines, Japan, UAE, South Korea, Hong Kong, Indonesia, Canada, Bulgaria, Ireland, Spain, Turkey, Russia, Switzerland, Scotland.

The interdisciplinary nature of the Jindal School of Banking & Finance offers an extensive curriculum encompassing areas like finance, accounting, technology, banking, law, analytics, applied economics, business, entrepreneurship and so on. These subjects are taught in tandem with the faculty going the extra mile to mentor students in thinking critically and having the means and understanding to solve problems.

The JSBF faculty has been meticulously chosen to be noble mentors and reliable guides to students, preparing each individual according to their interests and talents. This allows the Jindal School of Banking & Finance to be considered among the B.Com Hons best colleges in India.

The interdisciplinary curriculum at JSBF is systematically interpreted by the expert faculty members, guest lecturers and industry elites. The faculty has the real-world experience needed to advise students on a possible progressive route and acquire the ability to apply classroom knowledge in a professional setting.

Whether you want to pursue B.Com or a Master’s in Finance, research is one of the factors that helps students grasp various subjects. At the Jindal School of Banking & Finance, research and dissertation projects are considered integral to almost all undergraduate, postgraduate, and doctoral programs. It goes on to create a strong or the subject and its relation to contemporary matters, learn to collaborate with other members, and seek guidance whenever there is doubt.

The Jindal School of Banking & Finance has left no stone unturned in modeling its curriculum in accordance with global standards. For this goal alone, JSBF prioritises the recruitment of the most qualified professors, calls upon industry experts for guest lectures, and has established a network of international partnerships that allow students to gain professional insight and skills required in the future.

When studying a Master of Finance in India, the focus is equated among different topics related to finance, and developing an economic mindset. Unlike traditional courses on Economics as a separate discipline, banking and finance courses include economics as a means for students to be more vigilant in matters of finance and banking and identify the economic impact, for better or the worse.

The Jindal School of Banking & Finance, one of the reputed B.Com colleges in Delhi, knows very well the importance of undergraduate courses like B.Com Hons, and we are committed to empowering our students with the basic knowledge about banks and financial sectors and how these institutions are made functionable. The subjects included in the programme are further emphasised with teaching methods that promise a strong foundation in critical thinking, building professional certification, real-life business case-solving, analytical tools training, etc. Specialised B.Com programmes are also included in JSBF, like B.Com (Hons.) in Capital Markets and B.Com (Hons.) in Finance & Entrepreneurship.

The Master’s in Finance is a postgraduate programme that expands on the fundamentals of finance institutions, systems and functionality. The Jindal School of Banking & Finance has two specific Master’s programmes: M.Sc in Finance and Master’s in International Accounting & Finance (Accredited with ACCA). These are advanced educational programmes that focus on particular areas of banking and finance with a focus on skill-based training.

The undergraduate courses provide a foundation in the world of banking and finance, while the Master’s or postgraduate degree focuses on matters of specialisation. Both courses are somewhat similar in their interdisciplinary approach, along with skill-based training offered by industry experts. This global curriculum and exposure to industry in the top colleges in India for B.Com Honours prepares students to establish a career just after obtaining the degree.

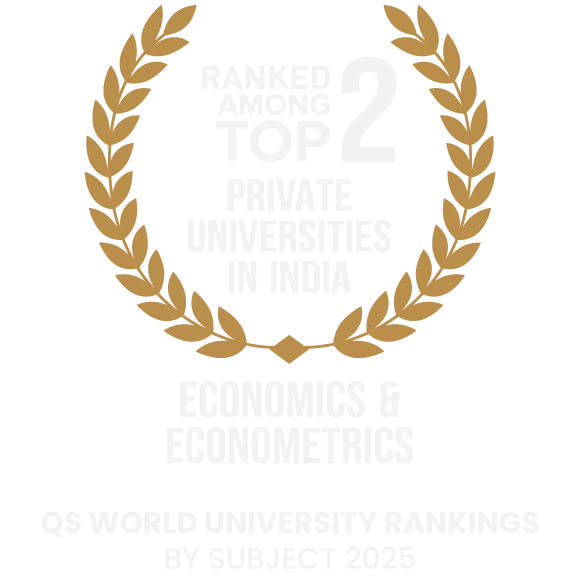

The Jindal School of Banking & Finance is ranked as the Number 1 private university in India in the QS World University Rankings 2023. This recognition on an international level, coupled with the multiple banking and finance-related courses offered at JSBF, makes them one of the B.Com Hons best colleges in India. We offer fundamental to expert-level training in all our undergraduate, postgraduate and doctoral programmes.